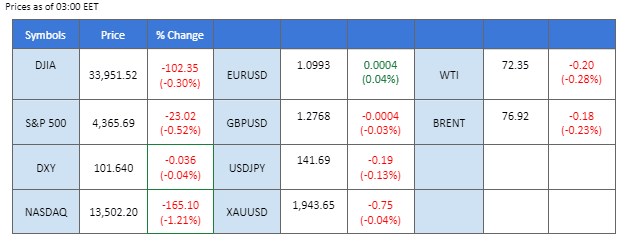

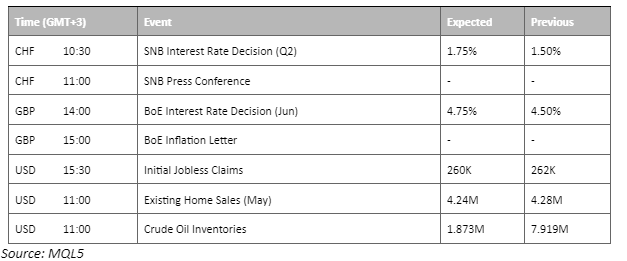

On the first day of Jerome Powell’s two-day testimony before the House, the Federal Reserve Chair delivered a semi-annual monetary policy report. The equity markets and the dollar both experienced declines as Powell took a hawkish stance, stating that the central bank would need to raise interest rates further to curtail U.S. growth and address inflationary pressures. Meanwhile, the U.K’s inflation remained persistent, with the Consumer Price Index (CPI) holding steady at 8.7%. Consequently, the Bank of England (BoE) is anticipated to continue raising interest rates in order to reach its targeted inflation rate of 2%. In another development, the European Union (E.U.) approved its 11th sanctions package against Russia. This move could potentially impact the global oil supply and lead to higher oil prices.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (28%) VS 25 bps (72%)

Federal Reserve Chairman Jerome Powell’s recent congressional testimony emphasised the central bank’s determination to rein in inflation, suggesting the possibility of additional interest rate hikes if the economy continues its current trajectory. Surprisingly, the US dollar experienced a notable selloff following Fed Chair Jerome Powell’s hawkish remarks. This unexpected market reaction suggests that global investors are still inclined towards a more dovish monetary policy stance from the Federal Reserve, disregarding the central bank’s statement. In a Reuters poll, economists predicted a decline of approximately 70 basis points in the yield on the 2-Year Treasury note over the next six months, projecting a drop from the current reading of around 4.70% to 4.00%.

The dollar index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 33, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 102.75, 103.35

Support level: 102.00, 101.35

Gold prices traded flat yesterday as investors adopted a cautious approach amidst uncertainties surrounding the future monetary policy outlook from the Federal Reserve. Despite the Fed’s hawkish tone during Chairman Powell’s testimony, investors remained sceptical, likely due to recent economic data reflecting a more pessimistic outlook. Moving forward, market participants should closely monitor key economic indicators such as the Consumer Price Index (CPI) and Non-Farm Payrolls (NFP) for potential trading signals

Gold prices are trading flat while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 41, suggesting the commodity might enter oversold territory.

Resistance level: 1955.00, 1980.00

Support level: 1930.00, 1895.00

Jerome Powell delivered his semi-annual monetary policy before the House, took a Hawkish stance, and is determined to bring the inflation rate down to 2%. However, the dollar plunged nearly 0.5% after the members of the house condemned his monetary policy, that led to millions of people losing their jobs. On the other hand, ECB officials constantly holding a hawkish stance claimed that the inflation in the Eurozone is stubborn and may require high-interest rates to contain the price pressures.

On the technical front, the RSI has once again broken into the overbought zone while the MACD crossed before dropping below the zero line, both giving a bullish signal for the pair.

Resistance level: 1.1030, 1.1088

Support level: 1.0951, 1.0848

BTC rallies on the ETF news continue and have broken above $30,00, the highest level since April. BlackRock submitted an application for a spot Bitcoin ETF while Citadel and Fidelity backing BTC allowed their client to access Bitcoin which boosted the confidence in Bitcoin. Last night, the dollar slumped after Jerome Powell delivered his semi-annual monetary policy report to the House, supporting BTC prices to edge higher.

BTC has traded strongly and broke its strong psychological resistance level at $30,000. The RSI remained in the overbought zone while the MACD was diverging, signalling a bullish signal for BTC.

Resistance level: 30400, 31750

Support level: 28670, 26960

The Japanese Yen got some room to breathe after trading to its 7-month low against the dollar. Despite the Fed’s chair eagerly wanting to contain the price pressures in the US and being determined to bring the inflation rate down to 2%, the dollar slumped by nearly 0.5% after his 1st day of the testimony. Notwithstanding the weakening dollar, the Japanese Yen remains sluggish as the BoJ monetary report shows the Japanese central bank remains dovish in its monetary policy, keeping its ultra-loose policy for longer.

USD/JPY is trading flat as the Japanese dovish monetary policy is offset by the weakening of the dollar. The RSI flowing above the 50-level while the MACD crossed on the above and moved toward the zero line.

Resistance level: 142.3, 143.70

Support level: 141.25, 140.18

Pound Sterling maintains its elevated position as the UK’s annual inflation rate unexpectedly held steady at 8.70% in May, as revealed by official data. This unexpected development has ignited hopes that the Bank of England will take decisive action to address the prevailing cost-of-living crisis. Currently, the UK’s inflation rate surpasses that of other G7 nations, amplifying expectations of an imminent interest rate hike by the central bank. Meanwhile, investors are eagerly awaiting the monetary statement following the Bank of England’s interest rate decision, as it will provide valuable insights into the central bank’s future course of action.

GBP/USD is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 54, suggesting the pair might be traded higher as technical correction since the RSI rebounded sharply from its midline.

Resistance level: 1.2980, 1.3270

Support level: 1.2695, 1.2300

The Dow dipped as the Federal Reserve’s hawkish statement had a discernible impact on the US equity market. Federal Reserve Chairman Jerome Powell’s recent congressional testimony emphasised the central bank’s determination to rein in inflation, suggesting the possibility of additional interest rate hikes if the economy continues its current trajectory. Powell explicitly stated, “We didn’t use the word pause, and I wouldn’t use it here today.” This statement underscores the Fed’s intention to maintain a proactive stance in addressing inflationary pressures.

The Dow is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 52, suggesting the index might extend its losses toward support level since the RSI retreated sharply from overbought territory.

Resistance level: 34210.00, 34835.00

Support level: 33685.00, 33155.00

The global oil market experienced a notable upswing as oil prices surged, driven by the recent depreciation of the US Dollar following the Federal Reserve’s testimony. The weakening of the greenback has rendered dollar-denominated oil more attractive for investors holding alternative currencies, thereby stimulating demand and bolstering prices. In addition, US oil inventories witnessed a substantial decline last week, as reported by the esteemed American Petroleum Institute. The figures revealed a remarkable slump in crude stock, plummeting by approximately 1.2 million barrels during the week ended 16th June.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 62, suggesting the commodity might extend its gains toward resistance level.

Resistance level: 74.00, 76.90

Support level: 69.85, 67.25

以行业低点差和闪电般的执行速度交易外汇、指数、贵金属等。