了解PU Prime最新的新闻和公告。

PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

Dear Valued Client,

PU Prime will implement the following adjustments to all MT4/MT5 Pro accounts starting from 17 June 2024 to enhance competitiveness and improve the trading environment as follows:

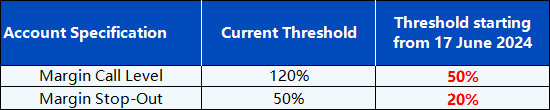

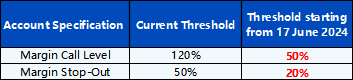

Please refer to the table below account specification outlined for adjustment:

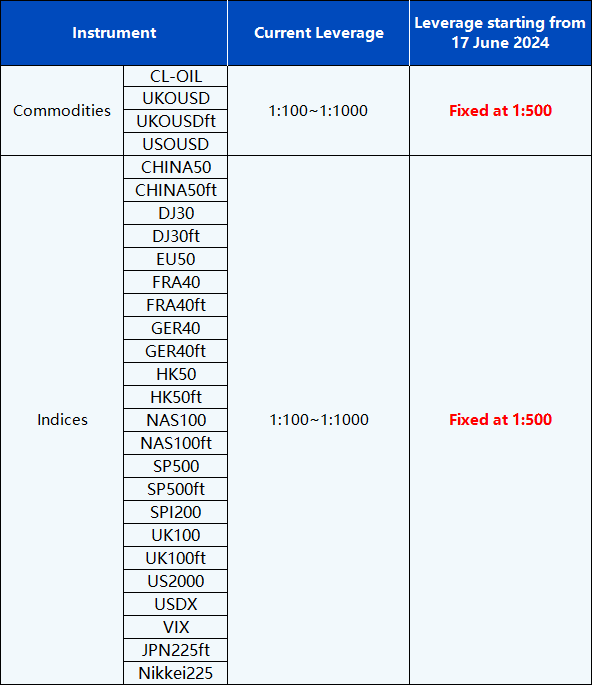

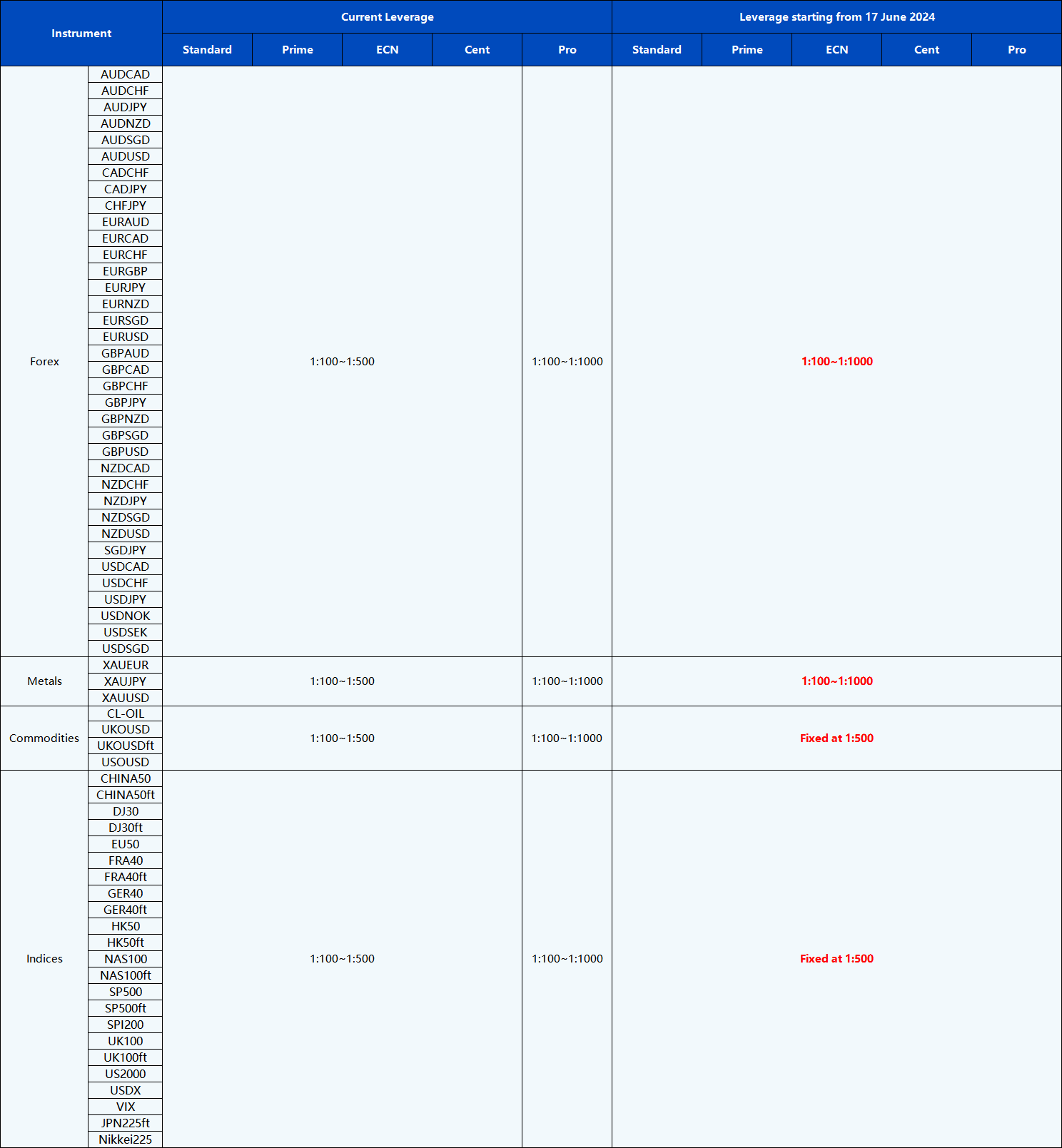

Please refer to the table below instrument outlined for leverage adjustment:

Important Note:

Dear Valued Client,

PU Prime will implement the following optmisation to all MT4/MT5 accounts starting from 17 June 2024 to enhance competitiveness and improve the trading environment as follows:

Please refer to the table below account specification outlined for optimisation:

Please refer to the table below instrument outlined for leverage optimisation:

Important Note:

If you choose 1:1000 as your maximum leverage, system will automatically adjust to 1:500 once your account equity surpasses USD 20,000 (or its equivalent in other currencies) without further notice. We recommend ensuring sufficient funds in your account and trading cautiously.

Dear Valued Client,

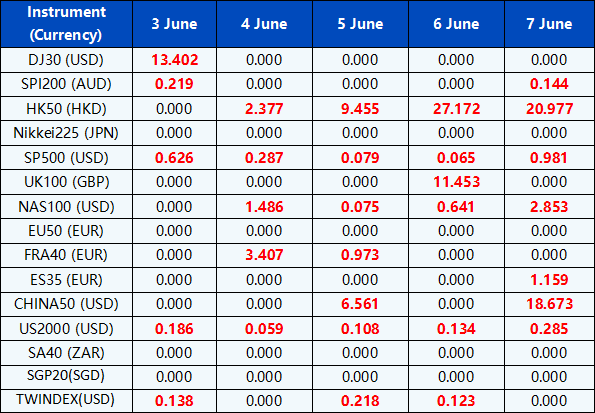

Please be advised that the dividends of the following index CFDs will be adjusted by upcoming ex-dividend dates. The comment for trading index CFDs will be in the following format “Div&<Product Name>&<Net Volume>” which show in the balance after the close of the day before the dividend payment date.

Please refer to the table below for more details:

*All dates are provided in GMT+3 (Server Time in MT4/MT5.)

Please note the above data are subject to changes. Please refer to MT4/MT5 for details.

If you have any questions or require any assistance, please contact our Customer Care Team via Live Chat, email: [email protected] or phone +248 4373 105.

Dear Valued Client,

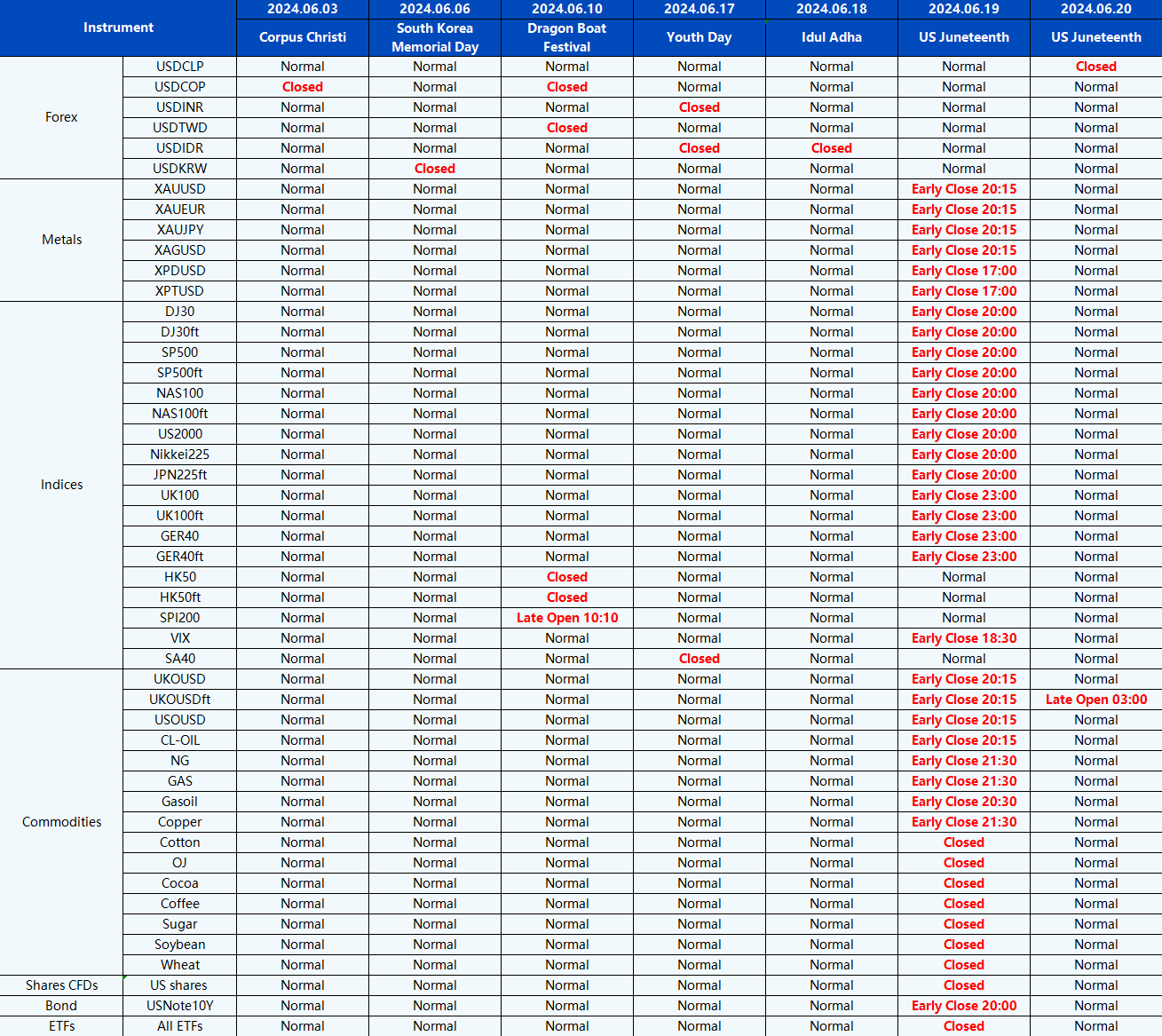

Please be advised that the following instruments’ trading hours and market session times will be affected by the upcoming June holidays.

Please refer to the table below outlining the affected instruments:

* All hours are provided in GMT+3 (Server Time in MT4/MT5.)

Note:

If you have any questions or require any assistance, please contact our support team via Live Chat, email: [email protected] or phone +248 437 3105.

Dear Valued Client,

Please be advised of the upcoming NVDIA Corp (NVDIA) stock split that is going to take place as per the following schedule:

The primary motive is to make the shares more affordable to small investors even though the underlying value of the company has not changed. NVDIA would like its stock to be more accessible to a broader base of investors.

Important notes of the NVDIA Stock Split

Please note that:

Example:

Investor current has an open BUY position of 100 shares at the price of USD 1063 with a Take Profit (TP) of USD 1100.

After the Stock split of 10 for 1: (Adjustment done would be as follows)

Position Price: USD 106.30 (USD 1,063/10)

Take Profit (TP): USD 110.00 (USD 1,100/10)

If you have any questions or require any assistance, please contact our support team via Live Chat, email: [email protected] or phone +248 437 3105.

Dear Valued Client,

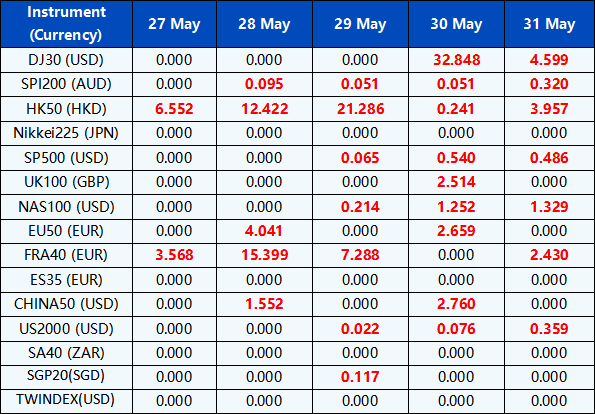

Please be advised that the dividends of the following index CFDs will be adjusted by upcoming ex-dividend dates. The comment for trading index CFDs will be in the following format “Div&<Product Name>&<Net Volume>” which show in the balance after the close of the day before the dividend payment date.

Please refer to the table below for more details:

*All dates are provided in GMT+3 (Server Time in MT4/MT5.)

Please note the above data are subject to changes. Please refer to MT4/MT5 for details.

If you have any questions or require any assistance, please contact our Customer Care Team via Live Chat, email: [email protected] or phone +248 4373 105.